42 valuing zero coupon bonds

Zero Coupon Bond | Definition, Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds ... Solved 2. Valuing a Zero-Coupon Bond. Assume the following | Chegg.com 2. Valuing a Zero-Coupon Bond. Assume the following information for existing zero-coupon bonds: Par value = $100,000 Maturity = 3 years Required rate of return by investors = 12% How much should investors be willing to pay for these bonds?

CFA 53: Introduction to Fixed-Income Valuation - Quizlet The spot curve, also known as the strip or zero curve, is the yield curve constructed from a sequence of yields-to-maturities on zero-coupon bonds. The par curve is a sequence of yields-to-maturity such that each bond is priced at par value. The forward curve is constructed using a series of forward rates, each having the same timeframe.

Valuing zero coupon bonds

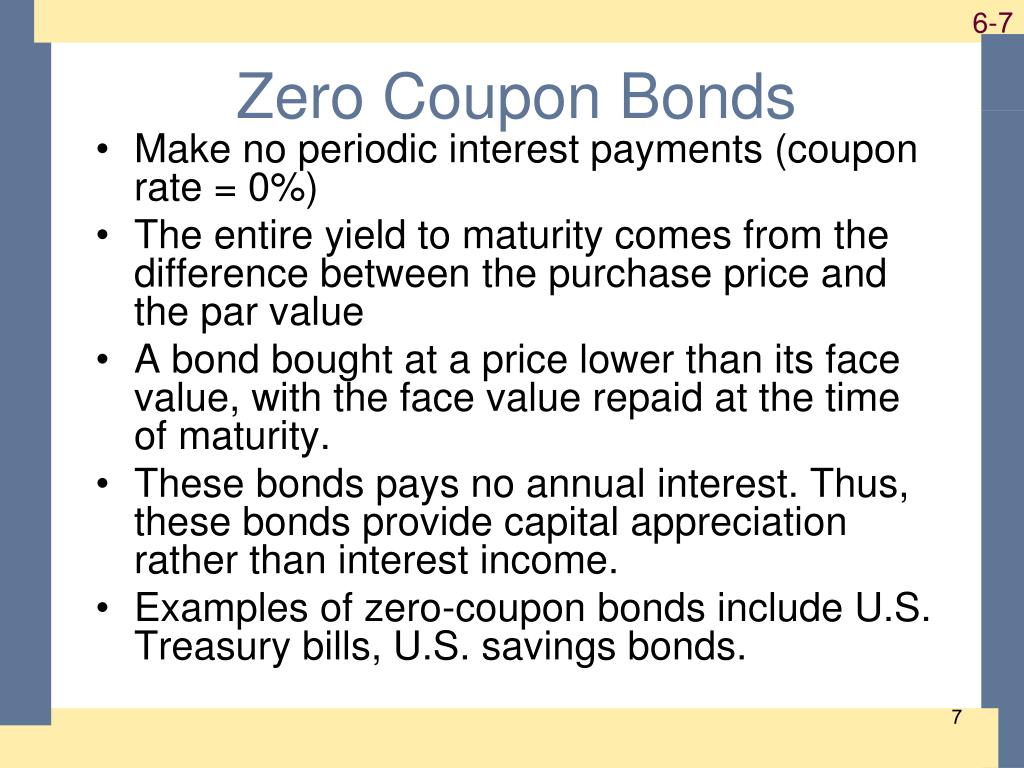

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ... PDF Coupon Bonds and Zeroes - New York University Coupon Bonds and Zeroes 6 Valuing a Coupon Bond Using Zero Prices Maturity Discount Factor Bond Cash Flow Value 0.5 0.9730 $425 $414 1.0 0.9476 $425 $403 1.5 0.9222 $10425 $9614 Total $10430 on the zero prices (discount factors) in the table below. These discount factors come from historical STRIPS prices (from an old WSJ). Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Valuing zero coupon bonds. efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Zero Coupon Bond Calculator - What is the Market Value? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds › learn › finance-fundamentalsFundamentals of Finance | Coursera In this module, you’ll examine fixed income valuation and delve deeper into the yield curve. Using the basic definition of bonds, you’ll be able to identify zero coupon bonds and calculate the return on those bonds. All the 21 Types of Bonds | General Features and Valuation | eFM 13.06.2022 · Different Types of Bonds Plain Vanilla Bonds. A plain vanilla bond is a bond without unusual features; it is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value. It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments.

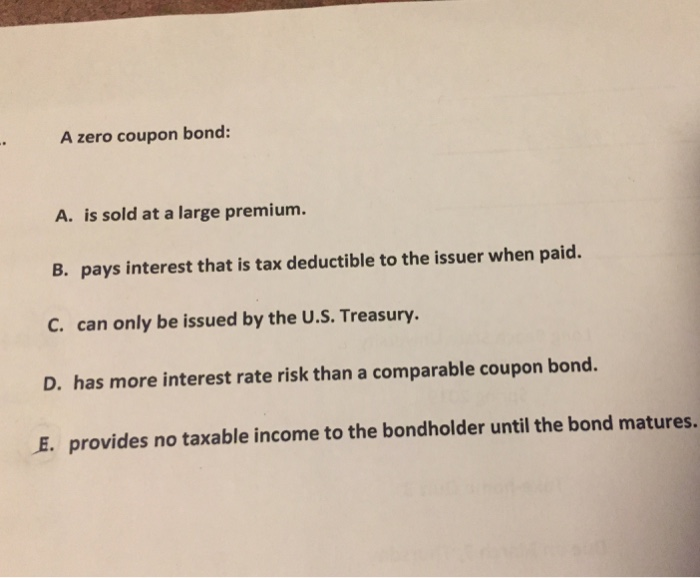

Reserve Bank of India - Frequently Asked Questions STRIPS in G-Secs ensure availability of sovereign zero coupon bonds, which facilitate the development of a market determined zero coupon yield curve (ZCYC). STRIPS also provide institutional investors with an additional instrument for their asset liability management (ALM). Further, as STRIPS have zero reinvestment risk, being zero coupon bonds, they can be attractive to retail/non ... Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... A zero-coupon bond can be described as a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder ... Calculate the Value of a Zero-coupon Bond - Finance Train Calculate the Value of a Zero-coupon Bond. Suppose you have a pure discount bond that will pay $1,000 five years from today. The bond discount rate is 12%. ... Since there are no interim coupon payments, the value of the bond will simply be the present value of single payment at maturity. Checkout our eBooks. Understanding Zero Coupon Bonds - Part One - The Balance Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value. Some issuers may call zeros before maturity. You must pay tax on interest annually even though you don't receive it until maturity. Zero coupon bonds are more volatile than regular bonds. Of the three kinds of zero coupon bonds ...

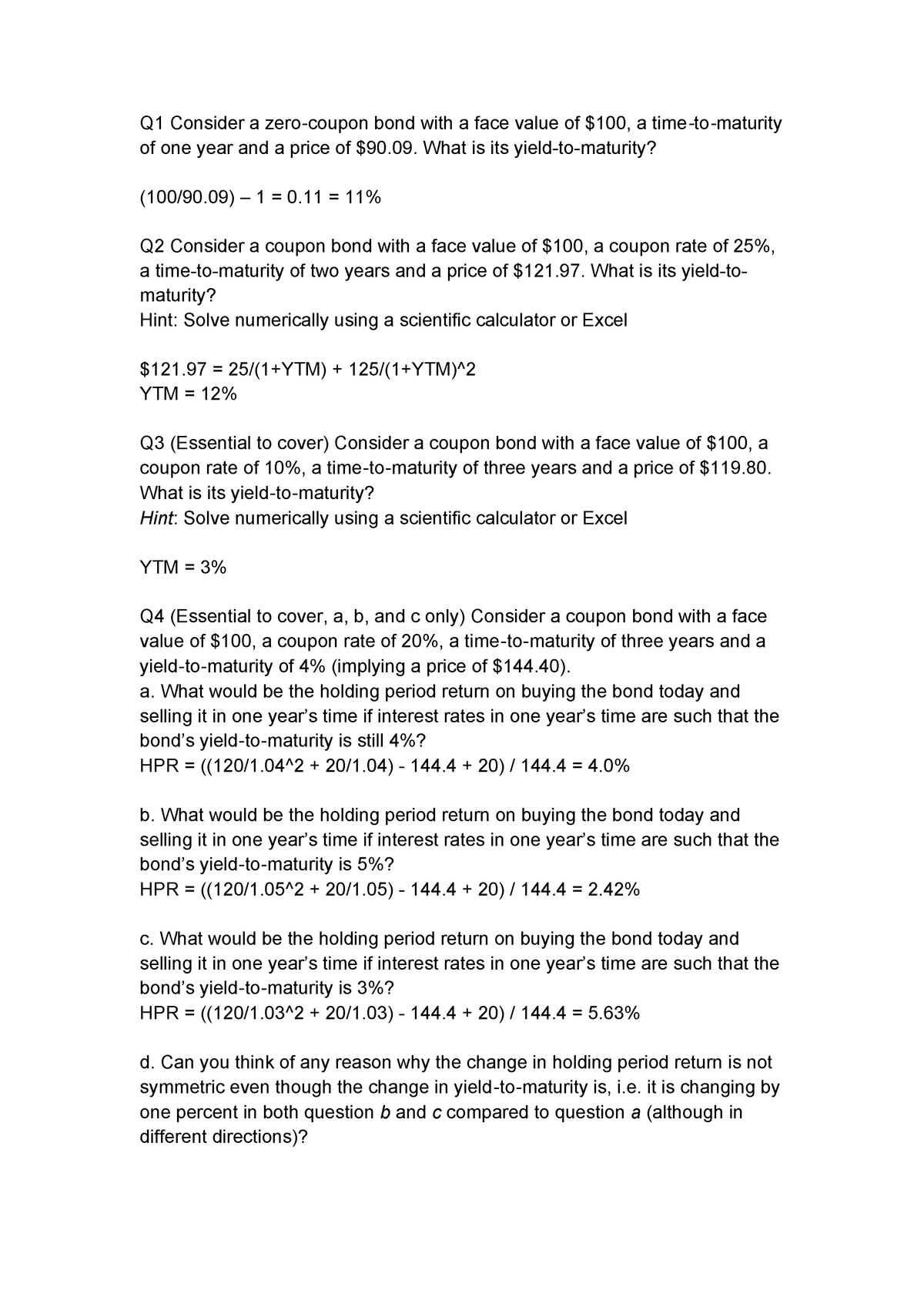

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Fundamentals of Finance | Coursera Holding Period Return and Yield to Maturity for Zero-Coupon Bonds 10m. Calculating the Holding Period Return on a Coupon Bond 10m. Topic 3 Lecture Slides 10m. Topic 3 Lecture Notes 10m. 1 practice exercise. Module 2 Quiz 30m. Week. 3. Week 3. 2 hours to complete. Module 3 - Equity Valuation. In this module, you’ll examine how to determine the value of stocks using present value methods. You ... Chapter 12: The Cost of Capital - Sacramento State Measurement of Project Risk Measurement of Project Risk Measurement of Project Risk Measurement of Project Risk Measurement of Project Risk Measurement of Project Risk Comparing risky projects using risk adjusted discount rates (RADRs) Non-simple Projects Non-simple projects Mutually Exclusive Projects With Unequal Lives Replacement Chain Approach Replacement Chain Approach … Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Valuing a zero-coupon bond | Mastering Python for Finance Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, is the annually compounded yield or rate of the bond, and is the time remaining to the maturity of the bond. Let's take a look at an example of a 5-year zero-coupon bond with a face value of $100. The yield is 5 percent, compounded annually.

Advantages and Risks of Zero Coupon Treasury Bonds General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000...

› indiv › kChapter 12: The Cost of Capital - Sacramento State Title: Chapter 12: The Cost of Capital Subject: Gallagher and Andrew Author: Gallagher Last modified by: kuhlejl Created Date: 6/19/1997 4:16:34 PM

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method

PDF Numerical Example in Valuing Zero coupon Bonds For example, the value of a zero coupon bond will increase from $385.00 to $620.92 as the bond moves from 10 years to maturity to 5 years to maturity assuming interest rates remain at 10%. 4) Compare the value of the zero at 10 years to maturity when rates are 10% versus when they are 7%. Lower interest rates mean higher bond prices.

Bond valuation and bond yields | P4 Advanced Financial … Since the bonds are all government bonds, let’s assume that they are of the same risk class. Let’s also assume that coupons are payable on an annual basis. Bond A, which is redeemable in a year’s time, has a coupon rate of 7% and is trading at $103. Bond B, which is redeemable in two years, has a coupon rate of 6% and is trading a t $102 ...

Zero-Coupon Bond Definition - Investopedia If the debtor accepts this offer, the bond will be sold to the investor at $20,991 / $25,000 = 84% of the face value. Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Should I Invest in Zero Coupon Bonds? | The Motley Fool So, for instance, if you spent $750 on a 10-year $1,000 zero coupon bond, then the fact that the bond was priced to yield around 3% would mean that you'd have to pay tax on 3% of its value each ...

Zero Coupon Bonds - Financial Edge Training Value and YTM of Zero Coupon Bonds. Bonds are valued by calculating the present value of future cash flows using an appropriate discount rate or interest rate. You can calculate the price of a bond using this formula: Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

quizlet.com › 157699276 › acct-223-chapter-7-flash-cardsACCT 223 | Chapter 7 Flashcards | Quizlet 2. Characteristics of Bonds a. A bond's _____ is generally $1,000 and represents the amount borrowed from the bond's first purchaser. b. A bond issuer is said to be in _____ if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations.

› Scripts › FAQViewReserve Bank of India - Frequently Asked Questions i) Fixed Rate Bonds – These are bonds on which the coupon rate is fixed for the entire life (i.e. till maturity) of the bond. Most Government bonds in India are issued as fixed rate bonds. For example – 8.24%GS2018 was issued on April 22, 2008 for a tenor of 10 years maturing on April 22, 2018.

Dividend Discount Model | Formula and Examples of DDM P 0 = Price at initial point of time zero with constant dividend growth; g = Dividend growth rate; Example of a Dividend Discount Model . Following are the example of DDM are given below: Example #1 – Zero Growth Model. Not taking into consideration that the company will grow.If a stock pays dividends of $1.50 per year and the required rate of return for the stock is 9%, then calculate the ...

ACCT 223 | Chapter 7 Flashcards | Quizlet 2. Characteristics of Bonds a. A bond's _____ is generally $1,000 and represents the amount borrowed from the bond's first purchaser. b. A bond issuer is said to be in _____ if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants.

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "42 valuing zero coupon bonds"