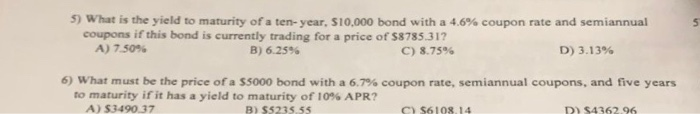

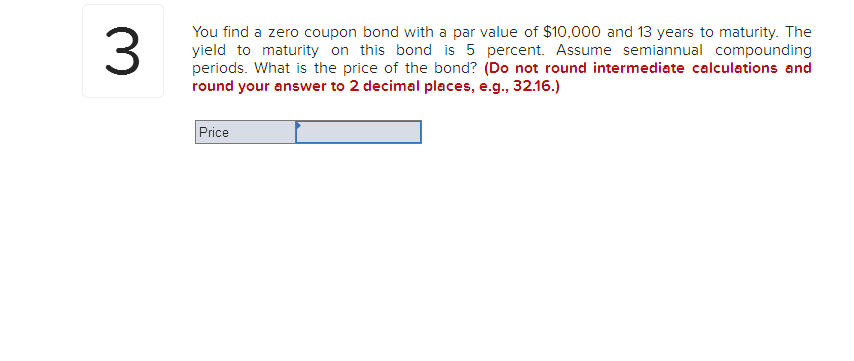

44 yield to maturity of zero coupon bond

Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Bond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. This means that if yields go up from 5% to 5.01% (a rise of 1bp) the price should fall by roughly 0.0976% or a change in price from $61.0271 per $100 notional to roughly $60.968.

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. …

Yield to maturity of zero coupon bond

PDF Zero Coupon Yield Curves Technical Doentation Bis DIVIDENDS Bonds: Spot Rates vs. Yield to Maturity Forward rates are implied by zero rates (FRM T3-11) FinMan Chapter 5 on bonds video 11 variations zero coupon bonds and duration Zero Coupon Bonds Return of zero coupon bond. Yield to Maturity of zero coupon bond Bond Yield to Maturity Calculator for Comparing Bonds So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate bond has a coupon that represents a fixed percentage of its par value. What is the difference between a zero-coupon bond and a ... A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Zero-coupon bonds are more volatile than coupon bonds, so...

Yield to maturity of zero coupon bond. Bootstrapping | How to Construct a Zero Coupon Yield Curve in ... Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ... How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be. Bond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market. Portfolio Duration Calculator Bond This will link directly to the original calculator page with all of your entries pre-filled and calculated The bond duration calculator computes Macaulay duration and modified duration of a bond if you know either the market price or the yield to maturity Bond X has 4% annual coupons and matures for its face value of $100 The Duration of a zero ...

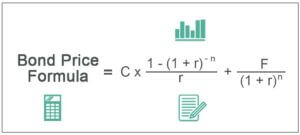

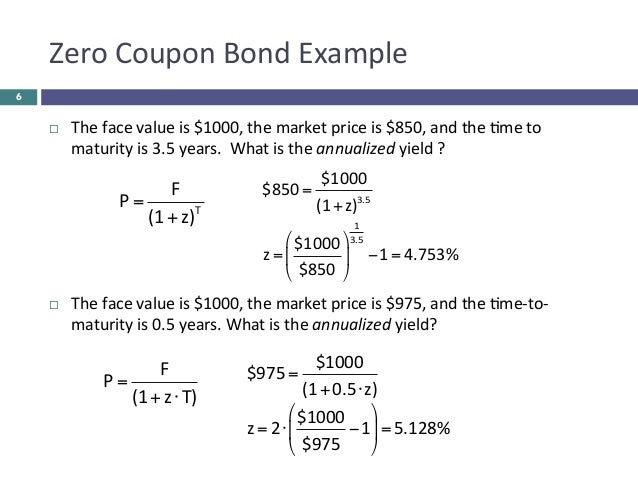

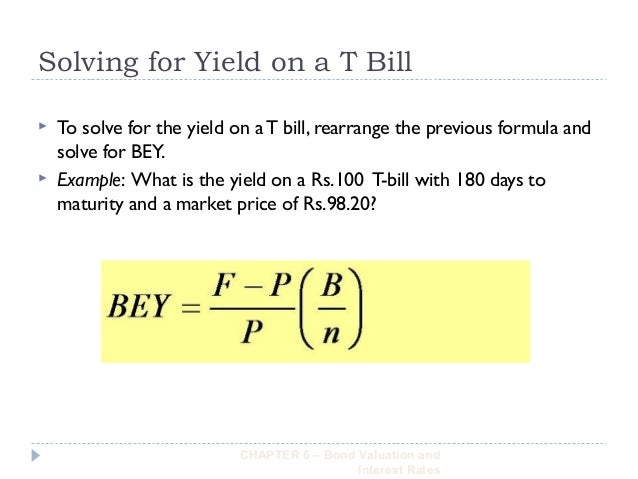

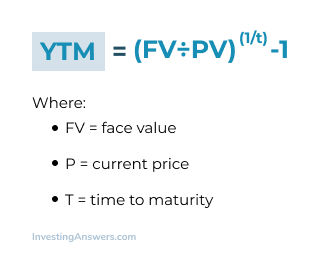

Consider the following zero-coupon yield curve on | Chegg.com Finance questions and answers. Consider the following zero-coupon yield curve on default free securities: Maturity Annual Yield to Maturity Periodic (Semi- Annual) Rate 6 Months 2.00% 1.00% 1 Year 2.30% 1.15% 1.5 Years 2.60% 1.30% 2 Years 3.00% 1.50% 2.5. Bond Yield to Maturity (YTM) Calculator - DQYDJ The Bond Yield to Maturity Calculator computes YTM using duration, coupon, and price. The approximate and exact ... and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600; Par Value: $1000; Years to Maturity: 3; Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Bootstrapping | How to Construct a Zero Coupon Yield Curve in … Yield to Maturity: 3%: 3.50%: 4.50%: 6%: ... Hence, the spot rate for the 6-month zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest.

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond at the time of... Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

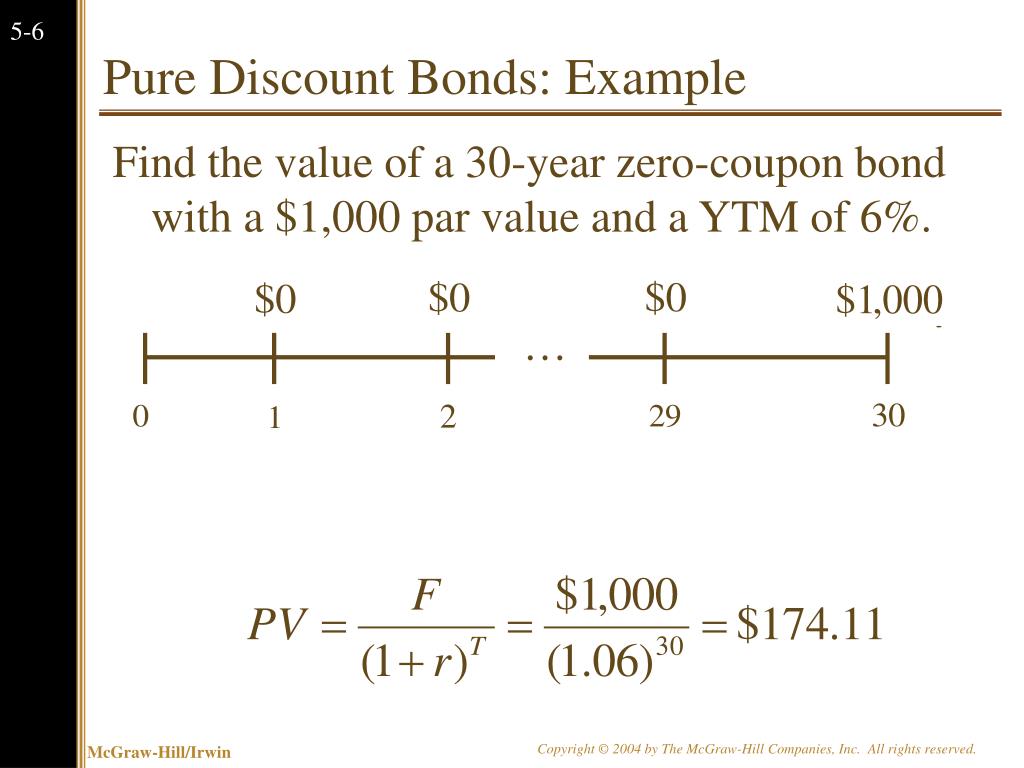

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

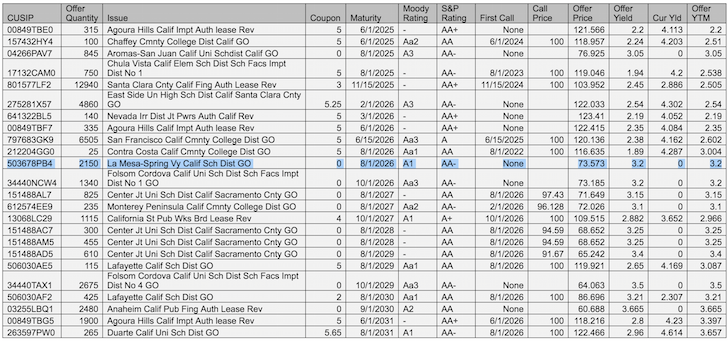

iShares USD Asia High Yield Bond ETF | O9P - BlackRock 04.07.2022 · The iShares USD Asia High Yield Bond ETF seeks to track the investment results of an index composed of USD-denominated high yield bonds issued by Asian ... Scientific consensus suggests that reducing emissions until they reach net zero around mid-century ... Coupon (%) Maturity Moody's Rating S&P Rating Barcap Rating Location ...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments.

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Solved 15, A zero-coupon bond has a yield to maturity of 9% | Chegg.com Transcribed image text: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ...

What is a Coupon Value? Definition and Calculation The bond yield changes as bond prices move, a factor bond traders consider in the secondary market. Below is a zero-coupon rate example: A zero-coupon rate bond does not pay an annual coupon rate; It has longer maturity dates and greater volatility but sells for a discount; An entity sells a 20-year zero-coupon rate bond at $5,000

Yield to Maturity (YTM) Definition - Investopedia Yield to maturity (YTM) is the total rate of return that will have been earned by a bond when it makes all interest payments and repays the original principal.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate.

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

Zero-Coupon Bond Definition - Investopedia 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05/2) 5*2 = $781.20 The price that John will pay for the bond today is $781.20.

Yield to Maturity – YTM vs. Spot Rate. What's the Difference? A zero-coupon convertible is a fixed income instrument that combines a zero-coupon bond and a convertible bond. ... Yield to maturity (YTM) is the total return ...

Post a Comment for "44 yield to maturity of zero coupon bond"