41 present value formula coupon bond

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · If you use a table, you will locate the present value factor for a 4% discount rate for 5 years. That factor is .822. The present value of $100 is ($100 X .822 = $82.20). The present value of your bond is (present value of all interest payments) + (present value of principal repayment at maturity). The formula for calculating the present - lvp.tonoko.info In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor.. The carrying value of a bond is that amount stated on the issuing entity's balance ...

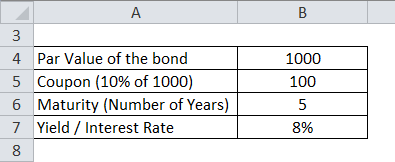

how to calculate bonds in excel? | iSeePassword Blog Assuming you have this information, you can use this formula: Interest = (Coupon Rate x Face Value x Days Until Maturity) / 365. For example, let's say you have a $1,000 bond with a 5% coupon rate that matures in 10 years. The market interest rate is 3%. Using the formula above, we would calculate the interest as follows: Interest = ($50 x ...

Present value formula coupon bond

Using the Present Value Formula to Value Bonds - HKT Consultant Each year until the bond matures, you are entitled to an interest payment of .06 X 100 = €6.00. This amount is the bond's coupon. 1 When the bond matures in 2025, the government pays you the final €6.00 interest, plus the principal payment of €100. Your first coupon payment is in one year's time, in October 2018. Bond Formulas - thismatter.com If the coupon bond is selling for par value, then the above formula can be simplified: Portfolio Duration = w 1 D 1 + w 2 D 2 + … + w K D K, w i = market value of bond i / market value of portfolio, D i = duration of bond i, K = number of bonds in portfolio, If sold before maturity, the - raa.brykczynscy.pl The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ... Calculate the spot rates implied by Bonds A, B, and D (the zero coupon bonds), and use this to check Bond C. (You may alternatively compute the spot Using the discounted free cash flow model ...

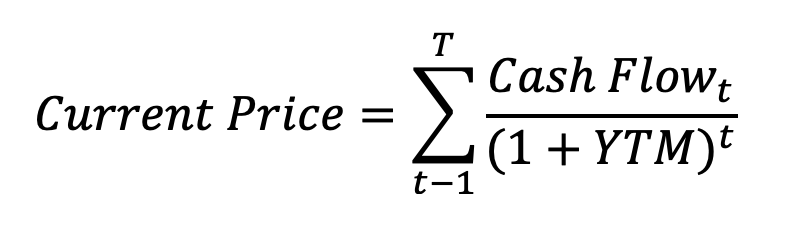

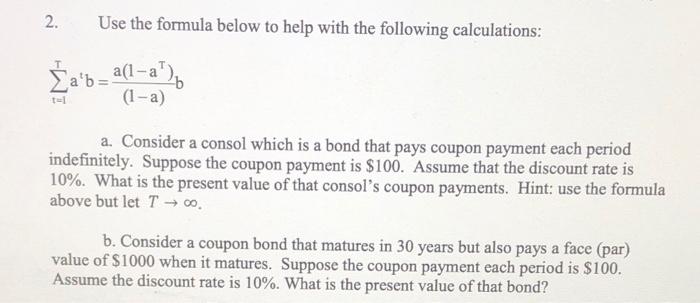

Present value formula coupon bond. Coupon Bond Present Value Formula - Stag Arms USA Coupon bond present value formula. Be the first to know about the latest Sports Direct UK sales and discount codes when you enter your email address in the newsletter subscription box. Email wet n wild makeup coupons 2012 coupon promo codes are good for only one purchase, and our community members share email codes for Rockettes and thousands ... Present value - Wikipedia A bondholder will receive coupon payments semiannually (unless otherwise specified) in the amount of , until the bond matures, at which point the bondholder will receive the final coupon payment and the face value of a bond, (+). The present value of a bond is the purchase price. Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. Bond valuation - Wikipedia Present value approach. Below is the formula for calculating a bond's price, which uses the basic present value (PV) formula for a given discount rate. This formula assumes that a coupon payment has just been made; see below for adjustments on other dates.

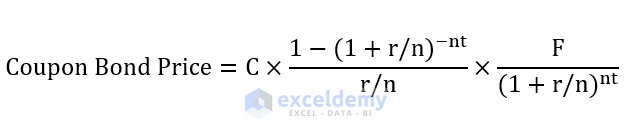

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. ... Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate. Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing is the calculation of the present value of the probable future cash flows, which comprises the coupon payments and the par value, which is the redemption amount on maturity. The rate of interest used to discount the future cash flows is known as the yield to maturity (YTM.) Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n, or, Excel formula: Bond valuation example | Exceljet In the example shown, we have a 3-year bond with a face value of $1,000. The coupon rate is 7% so the bond will pay 7% of the $1,000 face value in interest every year, or $70. However, because interest is paid semiannually in two equal payments, there will be 6 coupon payments of $35 each. The $1,000 will be returned at maturity. How to Calculate PV of a Different Bond Type With Excel - Investopedia The Accrued Interest = ( Coupon Rate x elapsed days since last paid coupon ) ÷ Coupon Day Period. For example: Company 1 issues a bond with a principal of $1,000, paying interest at a rate of 5% ...

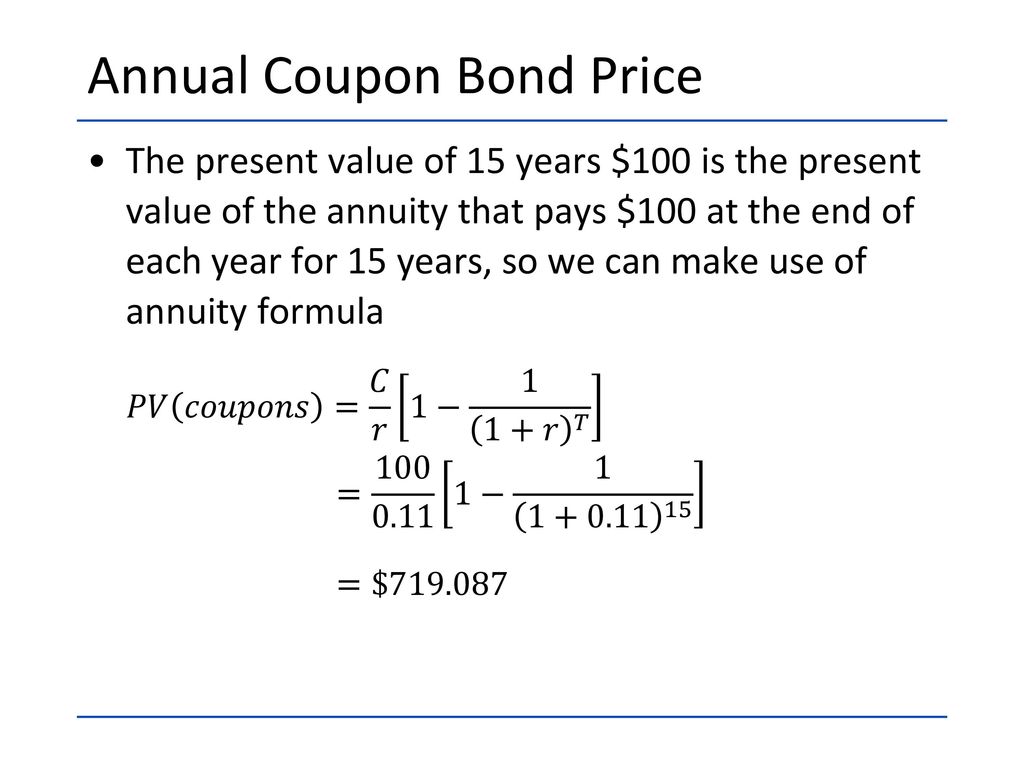

Time value of money - Wikipedia A typical coupon bond is composed of two types of payments: a stream of coupon payments similar to an annuity, and a lump-sum return of capital at the end of the bond's maturity—that is, a future payment. The two formulas can be combined to determine the present value of the bond. Valuing Bonds | Boundless Finance | | Course Hero F = face value, i F = contractual interest rate, C = F * i F = coupon payment (periodic interest payment), N = number of payments, i = market interest rate, or required yield, or observed / appropriate yield to maturity, M = value at maturity, usually equals face value, and P = market price of bond. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Bond Valuation: Calculation, Definition, Formula, and Example Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36, Present value of face value = 1000 / (1.015) 4 = 942.18, Therefore, the value of...

How to Calculate Present Value of a Bond - Pediaa.Com Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond. F = Face value of the bond. R = Market. t = Number of time periods occurring until the maturity of the bond.

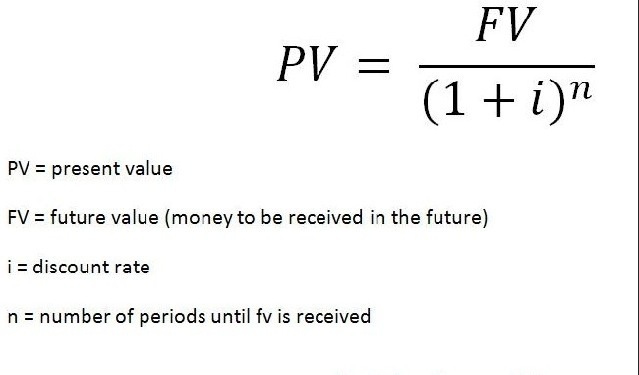

What Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

A set of yields-to- - apzl.real-tech.pl Apr 19, 2021 · to arrive at the present value of the principal at maturity. For this example, PV = $1000/ (1+0.025)^10 = $781.20. Add the present value of interest to the present value of principal to arrive at the present bond value. For our example, the bond value = ($467.67 + $781.20), or $1,248.87..

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below, Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16, Coupon Bond = $1,033,

Zero-Coupon Bond Primer: What are Zero-Coupon Bonds? Zero-Coupon Bond Yield-to-Maturity (YTM) Formula. The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price.

Excel yield to maturity formula - ham.szlaki-kajakowe.pl Learn how to calculate the Yield to Maturity (YTM) of bond using Excel in this video. Go through the other videos on this playlist to see how to solve many. where: PV = present value of the bond P = payment, or coupon rate × par value÷ number of payments per year r = required rate of return ÷number of payments per year Principal = par (face) value of. To calculate the current

Bond Formula | How to Calculate a Bond | Examples with Excel Template Bond Price is calculated using the formula given below, Bond Price = F / (1 +r / n) n*t, Bond Price = $1,000 / (1 + 5% / 1) 1*20, Bond Price = $376.89, Fund is calculated using the formula given below, Fund = Number of Bonds Issued * Bond Price, Fund = 10,000 * $376.89, Fund = $3,768,895 or $3.77 million,

How to calculate the present value of a bond — AccountingTools With this information, we can now compute the present value of the bond, as follows: Determine the interest being paid on the bond per year. In this case, the amount is $6,000, which is calculated as $100,000 multiplied by the 6% interest rate on the bond. Consult the financial media to determine the market interest rate for similar bonds.

If sold before maturity, the - raa.brykczynscy.pl The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ... Calculate the spot rates implied by Bonds A, B, and D (the zero coupon bonds), and use this to check Bond C. (You may alternatively compute the spot Using the discounted free cash flow model ...

Bond Formulas - thismatter.com If the coupon bond is selling for par value, then the above formula can be simplified: Portfolio Duration = w 1 D 1 + w 2 D 2 + … + w K D K, w i = market value of bond i / market value of portfolio, D i = duration of bond i, K = number of bonds in portfolio,

Using the Present Value Formula to Value Bonds - HKT Consultant Each year until the bond matures, you are entitled to an interest payment of .06 X 100 = €6.00. This amount is the bond's coupon. 1 When the bond matures in 2025, the government pays you the final €6.00 interest, plus the principal payment of €100. Your first coupon payment is in one year's time, in October 2018.

Post a Comment for "41 present value formula coupon bond"