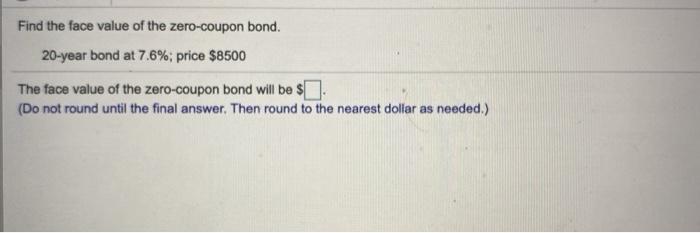

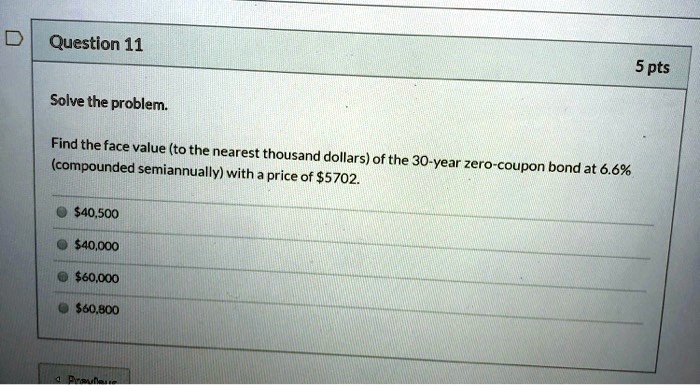

42 find the face value of the zero coupon bond

Literotica.com - Members - SZENSEI - Submissions Mar 08, 2017 · Mountain climbing just to find a Rose. Petals will fall! Exhibitionist & Voyeur 04/10/22: Cougar House Ep. 045: TURNING poINt (4.80) Early to bed, early to rise, that's the problem with all horny guys. Exhibitionist & Voyeur 04/17/22: Cougar House Ep. 046: Peak Performance (4.76) She'll be cumming on the mountain. She'll be cumming on the mountain. U.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah.

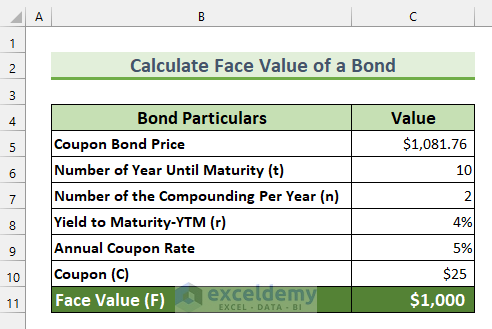

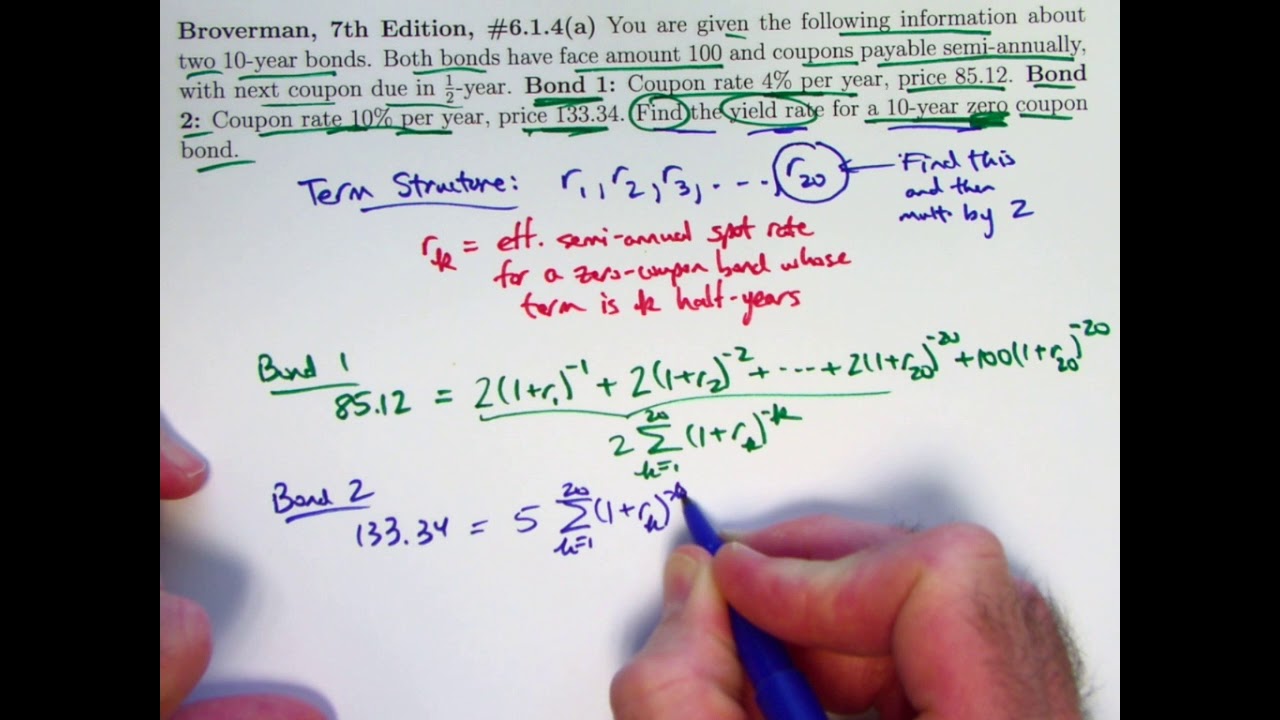

How to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508)

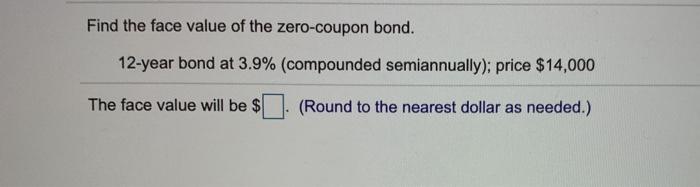

Find the face value of the zero coupon bond

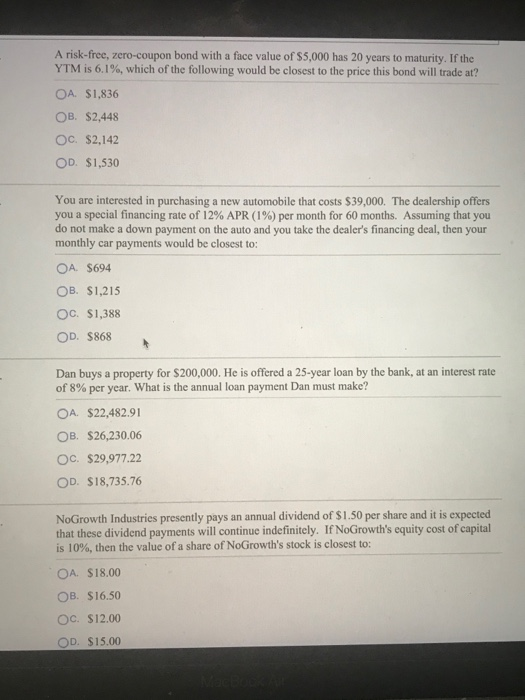

How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · Assume that a bond has a face value of $1,000 and a coupon rate of 6%. The annual interest is $60. Divide the annual interest amount by the number of times interest is paid per year. What Is the Face Value of a Bond? - SmartAsset Sep 21, 2022 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date.

Find the face value of the zero coupon bond. Publication 550 (2021), Investment Income and Expenses ... Enter the face value of all post-1989 paper Series EE bonds cashed in 2021 _____ 3. Multiply line 2 by 50% (0.50) _____ 4. Enter the face value of all electronic Series EE bonds (including post-1989 Series EE bonds converted from paper to electronic format) and all Series I bonds cashed in 2021 _____ 5. Add lines 3 and 4 _____ 6. Subtract line ... What Is the Face Value of a Bond? - SmartAsset Sep 21, 2022 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date. How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · Assume that a bond has a face value of $1,000 and a coupon rate of 6%. The annual interest is $60. Divide the annual interest amount by the number of times interest is paid per year. How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

Post a Comment for "42 find the face value of the zero coupon bond"